Send this article to my email

In this article, we’ll look at how to revaluate goods in 1C: Retail 2.2 Let’s formalize the revaluation operation for an existing item with set prices. We will also consider the case when we receive a new product item, and for it we need to fill in all the data and set price types.

First, let’s go to the “Types of Prices” directory in the “Marketing” section. A list of all price types will open. The point of this reference book is that each item can have several price values - purchase price, sales price, wholesale price and others.

The column “Method of setting prices” displays information about how each of them is formed. For example, “Purchase price” will be determined by the price from the receipt document, and “Retail” will be calculated. If we go to the last card, we will see that it is determined by a formula with different coefficients, based on the “Purchase Price”, broken down by price groups of goods.

To re-evaluate an existing product with a set price, return to the “Marketing” section and select the “Item Prices” item. In the document list form, click “Create”.

Let's determine, for example, the retail price by highlighting it with a tick. Next, click on the “Proceed to setting prices” button. In the window that opens, add to the tabular section the item that needs to be revalued. The “Old Price” column will indicate the current retail price, and in the “New Price” column we will set the new retail price. The program will automatically determine the percentage of price change.

If you have questions on the topic of how to revaluate goods in 1C: Retail, ask them in the comments under the article, our specialists will try to answer them.

Next, we will process the receipt of this position. Let's go to the “Purchases” section and select the “Receipt of goods” item. Let's fill out the header of the receipt document and add the newly created item to the tabular section. Let's set the price to 1 thousand rubles - this value will become the purchase price in the future.

In this case, a window will appear with a question about recalculating prices; answer “Yes”. Next, click on the “Set prices” button and select the “Calculate prices” action.

After that, the program will calculate the corresponding values for the selected price types. The purchase price from the receipt document was 1 thousand rubles. Retail price is 1,500 rubles, which is determined as the purchase price multiplied by a factor of 1.5. The small wholesale price is 1,350 rubles, which is determined as the retail price multiplied by a factor of 0.9. Next, we submit the completed document.

The price of a product has to be reduced for various reasons, but the goal is the same – its speedy sale. The markdown procedure must be carried out correctly and reflected correctly in accounting documents.

Let's consider the legislative basis for reducing the price of goods sold, some organizational features, as well as the nuances of reflecting this process in accounting.

What is a markdown

Markdown it is customary to call a reduction in the purchase price of a product that has been received or has been on sale for some time in order to facilitate its sale.

It is advisable to carry out such a procedure if one or more factors are present:

- the product is not in great demand;

- the products are stored in a warehouse or on store shelves;

- the product went on sale with damage (to the item itself or its packaging);

- the presentation is lost;

- consumer properties are partially lost;

- obsolescence of the item for sale;

- market fluctuations that affected demand, etc.

Both parties benefit from the discount:

- the buyer gets the opportunity to spend less funds to purchase;

- the seller sells the goods, thereby increasing his turnover.

What does the Law say about markdowns?

There are no strictly accepted norms for discounting goods. It is important that the Discount Regulations adopted in a particular trading organization do not contradict accounting standards and relevant government requirements:

- Federal Law of November 21, 1996 No. 129-FZ “On Accounting”;

- Order of the Ministry of Finance of the Russian Federation dated July 29, 1998 No. 34n “On approval of the Regulations on maintaining accounting records and financial statements in the Russian Federation”;

- The accounting plan, in particular, the contents of the “Inventories” account;

- Order of the Ministry of Finance of Russia dated June 13, 1995 No. 49 “On approval of the Guidelines for the inventory of property and financial obligations”;

- Letters from the State Statistics Committee approving document forms when conducting an inventory;

- Letter of Roskomtorg dated July 10, 1996 No. 1-794/32-5, which approved the Methodological Recommendations for accounting and registration of operations for the receipt, storage and release of goods in trade organizations.

How does the markdown procedure work?

Step 1 – solution. First, the management of the organization decides to reduce the selling price of the product. This can be done as a result of analyzing the renewal of the assortment and studying economic reports, as well as as a result of requests from heads of structural divisions who want to correct the current situation.

Step 2 – inventory. Having discovered an item that can no longer be sold at the current price, management must take inventory of it. This must be done not only according to the requirements of the Law, which obliges to carry out an inventory in the event of damage to goods (Clause 2 of Article 12 of Federal Law No. 129). Inventory is absolutely necessary in retail trade, since accounting cannot always know how much and what kind of goods are left in a particular outlet. Inventory takes place according to general rules:

- creation or activation of a permanent inventory commission (based on the order of the manager);

- checking the actual availability of goods (materially responsible persons take part);

- recording the quantity and condition of goods;

- entering the received information into the inventory list ();

- drawing up a comparison statement (), which will contain data on all identified discrepancies with accounting indicators;

- summing up the inventory - drawing up an accounting sheet () and.

Step 3 – markdown or write-off. If a product has completely lost its value, it must be written off. If you can still sell it, you need to re-evaluate it downwards. To do this, the following actions are carried out: the manager issues an order on revaluation, and on its basis a revaluation act(the form can be developed by the organization independently), which must include:

- names and articles of goods subject to markdown;

- characteristics defining these goods;

- quantity according to inventory data (in accepted units of measurement);

- both prices – old and established;

- reasons for which the markdown was made.

Markdown in accounting

New prices for goods can be reflected in accounting in different ways: it all depends on the method of valuing goods adopted in the policy of a particular retail outlet.

Accounting for goods at their acquisition prices (purchase prices)

This accounting method is used by both retail outlets and wholesale organizations.

- If the price of a product is reduced by an amount within the trade margin, there is no need to reflect this in accounting at all.

FOR EXAMPLE. The Home Everything store purchased the 10th batch of tablecloths (25 pieces) at a price of 200 rubles. per piece, putting them on sale for 350 rubles. (VAT included). 20 tablecloths were sold at this price, the rest were left in the store. Based on the results of the inventory, it was decided to discount the tablecloths by putting a price tag of 300 rubles on them. 3 more tablecloths were sold. What should the store accountant write down in the journal entries? Entries will vary in time.

- debit 90, subaccount “Cost of sales”, credit 41 – 4,000 rubles. (200 rub. x 20 pcs.) – write-off of the cost of tablecloths sold;

- debit 90 subaccount “Cost of sales”, credit 41 – 600 rub. (200 rub. x 3 pcs.) – write-off of the purchase price of sold tablecloths;

- debit 90 subaccount “VAT”, credit 68 subaccount “Calculations for VAT” - accrual of VAT on goods sold.

ATTENTION! This reserve is created for each unit of inventory according to accounting.

Then amounts from the reserve are written off as goods are sold: debit 14, credit 91 “Other expenses”.

Goods accounted for at sales prices

At the selling price, goods are taken into account, as a rule, in retail trade, separately highlighting trade markups.

- If the markdown amount falls within the markup limit, the accountant must make a reversing entry: debit 41, correspondence with the credit of account 42 “Trade margin”.

FOR EXAMPLE. Let’s take as a basis the previous example with the “Everything for the Home” store and discounted tablecloths, changing the accounting conditions: let the store keep records at sales prices, not purchase prices. In this case, the accounting entries will look like this:

In the month of delivery of a batch of tablecloths:

- debit 41, credit 60 – 5,000 rub. (25 pcs. x 200 rub.) – posting of a batch of tablecloths;

- debit 41, credit 42 – 3,750 rub. ((350 rub./pc. – 200 rub./pc.) x 25 pcs.) – reflection of the trade margin on the purchased batch of tablecloths;

- debit 50, credit 90, subaccount “Revenue” – 7,000 rubles. (350 rub. x 20 pcs.) – proceeds from the sale of tablecloths;

- debit 90, subaccount “Cost of sales”, credit 41 – 7,000 rubles. – write-off of tablecloths at sales price;

- debit 90 subaccount “Cost of sales”, credit 42 – 3000 rub. ((350 rub./pc. – 200 rub./pc.) x 20 pcs.) – the trade margin on tablecloths sold has been reversed;

- debit 90 subaccount “VAT”, credit 68 subaccount “Calculations for VAT” - accrual of VAT on goods sold.

In the month of sale of discounted tablecloths:

- debit 41, credit 42 – 1000 rub. (350 rub./piece - 300 rub./piece) x 20 pieces) – the trade margin on the discounted tablecloths remaining for sale has been reversed;

- debit 50, credit 90, subaccount “Revenue” – 900 rubles. (300 rub. x 3 pcs.) - reflection of revenue from the sale of tablecloths at a new price;

- debit 90 subaccount “Cost of sales”, credit 41 – 900 rub. (200 rub. x 3 pcs.) – write-off of the sales value of sold tablecloths;

- debit 90 subaccount “Cost of sales”, credit 42 – 300 rub. ((300 rub./pc. – 200 rub./pc.) x 3 pcs.) – reduced (trade margin on sold discounted tablecloths reversed.

- debit 90 subaccount “VAT”, credit 68 subaccount “Calculations for VAT” - accrual of VAT on goods sold.

RESULT. If the goods, although they were discounted, were sold above cost, the organization makes a profit. If the markdown turned out to be greater than the cost, the sale turned out to be a loss. Both financial results are recognized in tax accounting based on the results of the reporting period (clause 2 of Article 268 of the Tax Code of the Russian Federation).

IMPORTANT! If the price deviation exceeds a fifth of those accepted on the market, then additional taxes may be assessed during control.

Step 1. Setting up accounting policies

Revaluation must be done if retail goods are valued at sales value. In 1C 8.3, this must be recorded in the organization’s accounting policies:

To register a revaluation in 1C 8.3, you must perform the following steps:

- Use to set new prices for goods;

- Document Revaluation of goods at retail reflect price changes in accounting.

Let's consider step by step instructions revaluation of retail goods in 1C 8.3 using an example.

Example. As of June 30, 2016 LLC "Success" in the retail warehouse "Warehouse Store No." lists the following product. Due to the increase in purchase prices, it was decided to increase sales prices from July 12, 2016. by 30%:

We will consider price changes using the Felt Pens product range as an example. As can be seen from the balance sheet for account 41.11 as of 06/30/2016. There are 150 markers in stock for the amount of 4,500 rubles. The selling price of one felt-tip pen is 4,500/150 = 30 rubles.

The sales price can also be viewed in the item card by clicking the Price button, indicating the date for which you want to view the set price. As you can see, in the card the selling price is Retail as of 06/30/2016. is also equal to 30 rubles:

Step 2. Setting new selling prices

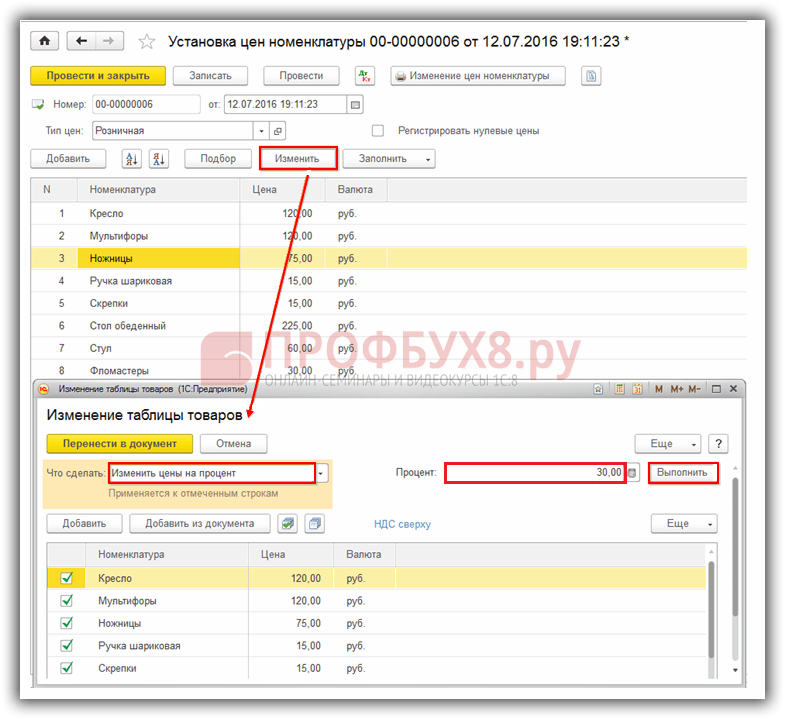

In 1C 8.3 document Setting item prices there is a section Warehouse → Prices → Setting item prices:

Let's draw up the document Setting item prices in 1C 8.3. Document date 07/12/2016, since new prices should begin to apply from 07/12/2016. To fill out the tabular part of the document, you can use any available option: Add, Select or Fill. Use the Fill button and select Fill by item prices:

With this option, the tabular part will include the item with a set retail price. To change prices in 1C 8.3, use the button Change. In the window that opens, indicate what needs to be done. In our case Change prices by percentage. Next, indicate what percentage - 30% and the button Run:

As a result of these actions, prices will be increased by 30%:

Press the button Move to document and the recalculated prices will be transferred to the tabular part of the document Setting item prices. We carry out the document:

Let's go to the Felt Pens nomenclature card and check what the selling price is as of 07/12/2016. As you can see, the retail price is 39 rubles. This means the new sale price will be valid from 07/12/2016:

Step 3. Document Revaluation of goods in retail

Create a new document in 1C 8.3: section Warehouse → Prices → Revaluation of goods in retail:

In the document we indicate:

- On what date will we do the revaluation – 07/12/2016;

- In which warehouse – Warehouse Store No. 2;

- What document established the new prices - Setting prices for item 00-00000006 dated 07/12/2016. 0:00:00.

To fill out the table part, use the button Fill in and Fill in balances:

The remaining items will be transferred to the document, indicating the old and new prices. We carry out the document:

Let's look at the postings generated by the document Revaluation of goods at retail in 1C 8.3. As you can see, the debit of account 41.11 reflected an increase in the sales price:

Let's analyze the balance sheet for account 41.11 as of July 12, 2016:

As can be seen from the “turnover”, the selling price of one piece. nomenclature “Felt-tip pens” is equal to 5,850/150 = 39 rubles. This means that after the actions performed in 1C 8.3, the revaluation in accounting is reflected correctly.

If the valuation of goods at an enterprise is carried out at purchase prices, then one document is sufficient to reflect price changes in the 1C 8.3 program Setting item prices:

Please rate this article:

Registration procedure:

1. Setting new retail prices

To set a specific price for a product item linked to a specific price type, use the document "Setting item prices". It is not allowed to set multiple price values of the same type for an item within one day.

Creating the document "Setting item prices" (Fig. 1):

- Call from the menu: Warehouse - Prices - Setting item prices.

- Click the button Create.

Filling out the document “Setting item prices”, new price type “Retail” (Fig. 2):

- In field from indicate the date of the document. From this date, the prices specified in the document will be valid until new ones are established by a similar document.

- In field Price type indicate the price type "Retail", which is set for the item specified in the tabular section.

- Click the button Fill - Fill according to item prices, the tabular part will be filled with product items that are assigned the “Retail” price type.

- Leave in the table section only those products for which a discount is provided (Fig. 3).

Performing processing for group price changes in the document “Setting item prices” (Fig. 3):

In our example, a 30% discount is provided from the previously established retail price. We will set new prices using processing.

- Select the type of processing. In our case, we select " Change prices by percentage".

- Set the percentage of price change from the price type " Retail". In our example - 30%.

- Click on the button Execute once. Prices will change automatically for each type of item specified in the table section.

- Button Move to document.

Prices are set in the document “Setting item prices”. A new price type "Retail" with a 30% discount has been installed. Prices must be checked and clicked Swipe and close(Fig. 4).

Let's check the changed retail price set for a specific type of item on a specific date (Fig. 5):

- Call from the menu: Directories - Products and services - Nomenclature.

- In the directory Nomenclature Open the item for which you want to view prices.

- Select a subdirectory Item prices.

- In field Get/set prices for a date Select the date for which you would like to receive pricing information.

- The prices set for this type of item will appear in the tabular section. The "Document" column indicates the document that set this price.

2. Revaluation of goods.

In connection with the provision of a 30% discount on retail goods, it is necessary to change the sales price at which retail goods are recorded on account 41.11. To perform the operation "Revaluation of retail goods", you must create a document "Revaluation of goods in retail". As a result of this document, the corresponding transactions will be generated.

Before revaluing goods, you can see at what price the goods are accounted for in account 41.11 “Goods in retail trade (in ATT at sales value).” To do this, you can use the report Balance sheet for account 41(in our case - according to subaccount 41.11).

To do this, do the following (Fig. 6):

- Call from the menu: Reports - Standard reports - Account balance sheet.

- In the fields Period select the period for which the report is generated.

- In field Check select account 41.11.

- Click the button Form.

In the balance sheet on the debit of account 41.11 “Goods in retail trade (in ATT at sales value)” there is a balance of 27,000.00 rubles. for the product "Phone case" (quantity 30 pieces). The selling price of a unit of goods (before revaluation) is 27,000.00 / 30 = 900.00 rubles.

Creating the document "Revaluation of goods in retail" (Fig. 7):

- Call up menu: Warehouse - Prices - Revaluation of goods in retail.

- Click the button Create.

Filling out the document “Revaluation of goods in retail” (Fig. 8-9):

- In field from indicate the date of revaluation of retail goods.

- In field Stock select from the directory "Warehouses (storage locations)" the warehouse where the revaluation of retail goods will be carried out.

- In field Document for setting prices, select the document that was used to change the “Retail” price type.

- By balances, the tabular part will be filled with the remaining goods in the specified warehouse, taking into account current prices and revaluation.

- Check that the fields are filled in as shown in Fig. 9.

The result of the document “Revaluation of goods in retail” (Fig. 10):

To post a document, click the button Conduct, to view transactions, click the Show transactions and other document movements button.

To check the cost of retail goods after revaluation, you can generate Balance sheet for account 41.11“Goods in retail trade (in ATT at sales price)” (Fig. 11).

Revaluation of goods is the determination of the difference between the cost of goods at previous retail prices and the newly introduced price for the goods. When the new price is lower than the previous one, the product is marked down; if it is higher, then it is revalued.

Revaluation of goods during markdown can be associated both with low consumer demand for the goods being sold, and with ongoing promotions, or, for example, due to a decrease in the quality of the goods, due to obsolescence, when the functional properties of the goods do not keep up with progress, and many other reasons. Revaluation may occur, for example, for reasons of purchasing similar goods at higher prices.

Commodity revaluation is drawn up in a document in which you need to indicate the name of the product, its quantity, storage unit, previous and new price. All changes in prices, according to the law, must be carried out only on the basis of an order from the head of the company. The amount of data that has to be manipulated during such procedures can be significant. The functionality of the 1C:Accounting software product helps the accountant to re-evaluate or mark down goods in the warehouse in the shortest possible time and without headaches.

In “1C: Accounting”, revaluation is done using the document “Revaluation of Goods”, from which you can print a form containing information about the revalued product indicating the new price entered.

Commodity revaluation is carried out only in companies that have organized accounting of goods at sales prices on account 41.11 “Goods in retail trade” (in the “Automated point of sale at sales price”). Such goods are taken into account in a warehouse with the “Retail store” type.

The goods can be delivered either directly to the retail warehouse or to the wholesale warehouse.

In the first case, it is necessary to immediately set retail prices for incoming goods using the document “Setting item prices”. When it is carried out, a markup will immediately be allocated for the goods sold at retail.

For example, a retail warehouse received 200 pieces of goods. at the admission price of 170 rubles. We set the retail price at 250 rubles. When conducting a receipt, the program capitalizes on November 41 the goods at the purchase price in the amount of 34,000 rubles, and the difference between the purchase and sale prices in the amount of 16,000 rubles. will be reflected in account 42.01 “Trade margin in automated retail outlets.” As a result, the goods will be listed on account 41.11 at the retail price, and the markup will be on account 42.01.

When goods are first received at a wholesale warehouse and then transferred to a retail store, the additional valuation to the retail price is carried out not by the receipt document, but through the “Transfer of Goods”. And in this case, it is also necessary to pre-set retail prices, since these are the prices at which the goods are sold in the store.

When there is a need to re-evaluate a product, for example, the retail price of our product has increased, this is reflected in the document “Setting item prices”.

It is necessary to create a document “Revaluation of goods”. To do this, go to the revaluation document and click “Fill in at changed prices.” The program sees that the retail price of our product has changed and adds it to the tabular section, and immediately enters the old and new prices. All that remains is to carry out the document.

If the new price is reduced relative to the old one, the revaluation will occur in red.

You can fill out the revaluation document with a list of goods using the “Add” buttons, but in this case you will have to manually fill in all the fields, and through “Fill” the document will receive data on all balances in the warehouse or only on changed prices, as happened above.

From the document you can print the form “Revaluation of goods in retail” displaying the product, its old and newly set price.

Thus, when the price of a product changes, it is necessary to re-evaluate all goods that are in stock to the new retail price. In the 1C: Accounting program, all processes are quite simple and fairly automated; it will not be difficult for a company accountant to quickly and fully revaluate goods in 1C and carry out the necessary revaluation of goods in the warehouse.